The Medicaid Income Limit is the most important criteria for deciding whether you qualify for Medicaid in your state. In this post, we are going to provide the Medicaid Income Limit by state.

Based on this information, you will be able to determine whether your income qualifies you or Medicaid in your state or not.

This post on “Medicaid Income Limits” we will cover:

- What is Medicaid?

- What group of people are covered by Medicaid?

- Who is eligible for Medicaid?

- Medicaid Income Limits by State

What is Medicaid?

Medicaid is a federal and state health insurance program for people with a low income.

It provides free or low-cost health coverage to millions of Americans, including families and children, pregnant women, the elderly, and people with disabilities.

The Children’s Health Insurance Program (CHIP) offers health coverage to children in families with incomes too high to qualify for Medicaid, but who can’t afford private coverage.

How Many People are on Medicaid?

According to the Centers for Medicare & Medicaid Services, as of July 2019

- 72,139,715 individuals were enrolled in Medicaid and CHIP

- 65,527,476 individuals were enrolled in Medicaid.

- 6,612,239 individuals were enrolled in CHIP.

Who is eligible for Medicaid?

You should apply for Medicaid if your income is low and you match one of the descriptions below:

- You think you are pregnant

- You are a child or teenager

- You are age 65 or older

- You are legally blind

- You have a disability

- You need nursing home care.

You may be automatically eligible for Medicaid if you receive any of the following:

- Supplemental Security Income (SSI)

- Cash Assistance

- State/County Special Assistance for the Aged or Disabled

When you apply for Medicaid, your application will be carefully reviewed by a caseworker.

In general, you should apply for Medicaid if you match the descriptions below:

Pregnant Women

Apply for Medicaid if you think you are pregnant. If you are on Medicaid when your child is born, both you and your child will be covered.

You may be covered for another 60 days after your child’s birth. Your child may be covered for up to one year.

Children and Teenagers

Apply for Medicaid if you are the parent or guardian of a child who is 18 years old or younger and your family’s income is low.

You should also apply if your child is sick enough to need nursing home care but could stay home with good quality care at home.

If you are a teenager living on your own, you may apply for Medicaid on your own behalf.

Aged, Blind or Disabled People

Apply if you are aged (65 years old or older), blind or disabled, and have low income and few resources (such as bank accounts, real property or other items that can be sold for cash).

You should also apply if you are terminally ill and want to receive hospice services.

If you are aged, blind or disabled; live in a nursing home, and have low income and limited assets, you should consider applying for Medicaid.

Apply if you are aged, blind or disabled and need nursing home care but can stay at home with special community care services.

Finally, apply if you are eligible for Medicare and have low income and limited assets.

Other Groups Eligible for Medicaid

You should consider applying for Medicaid if you are eligible for or leaving Temporary Aid for Needy Families (TANF) and need health care coverage.

In addition, if you are a family with children under 18 and have very low or no income and few assets. (You do not have to be receiving TANF.), you should consider applying for Medicaid.

Also, apply if you are a woman with breast or cervical cancer.

Finally, if your income is higher than the limits (See income limit below) and you have medical bills you owe (and you are pregnant, under 18 or over 65, blind or disabled), consider applying.

Medicaid Eligibility Criteria

Whether you qualify for Medicaid depends on a variety of factors, including whether your state has expanded their Medicaid programs to cover all people with household incomes below a certain level.

In addition, you must meet the following eligibility rules:

- Be a resident of the state you are applying in

- Be a U.S. citizen or a qualifying noncitizen

- Provide a Social Security number for each person requesting coverage, unless an exception is met

- Meet income and asset limit

- Meet any other program rules that are specific to your state.

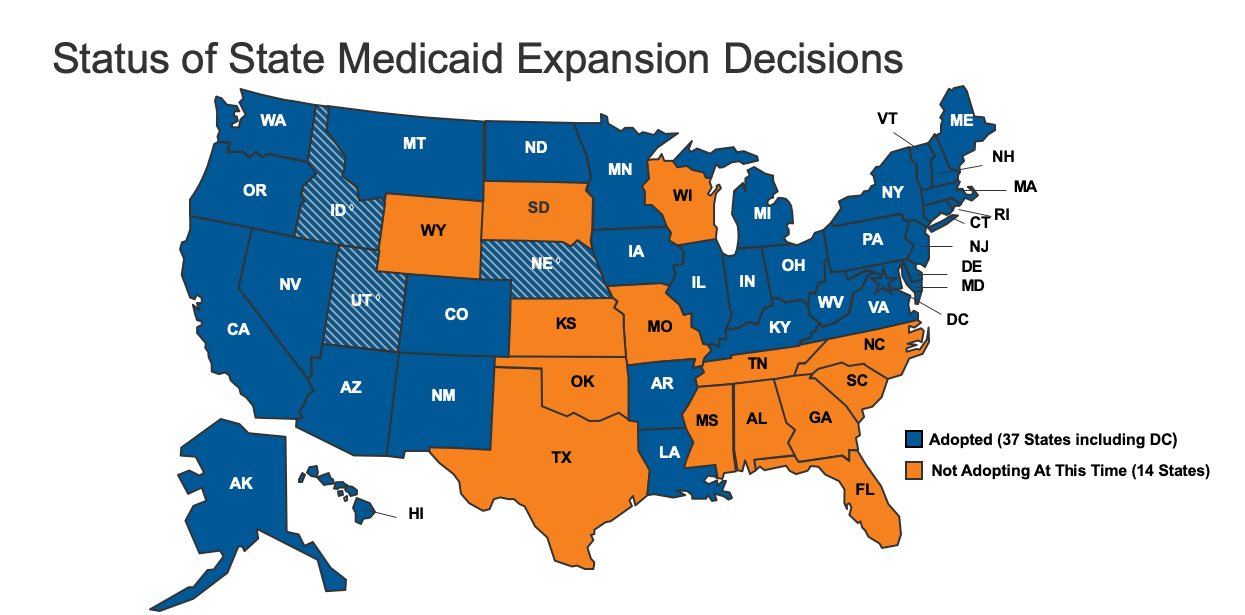

Medicaid Expansion – Update

As of November 2019, here is the status of Medicaid Expansion:

As shown by the image below, To date, 37 states (including DC) have adopted the Medicaid expansion and 14 states have not adopted the expansion.

If your state has expanded Medicaid coverage, this means that as an adult with low income, you may be eligible for Medicaid if your income meets a certain limit.

Source: KFF

Medicaid Income Limits by State

In order to qualify for this Medicaid, you must be in need of health care/insurance assistance, and your financial situation must fall under low income or very low income.

The Medicaid income limit is based on a percentage of the Federal Poverty Levels.

States generally divide Medicaid recipients into four Categories. Each of these categories has it’s income limit based on the Federal Poverty Level. The four categories are:

- Infants and Children

- Families with Dependent Children

- Pregnant Women

- Aged, Blind, and Disabled

- Adults – If your State Expanded Medicaid

Below is the 2019 federal poverty level based on the number of people in your household.

| People in household | Poverty guideline |

|---|---|

| 1 | $12,490 |

| 2 | $16,910 |

| 3 | $21,330 |

| 4 | $25,750 |

| 5 | $30,170 |

| 6 | $34,590 |

| 7 | $39,010 |

| 8 | $43,430 |

| Over 8 people | Add $4,420 per extra person |

The federal poverty level in Alaska ranges from $15,600 (for one person) to $54,310 (for eight people). The federal poverty level in Hawaii ranges from $14,380 (for one person) to $49,940 (for eight people).

Here are the individual State Medicaid Income Limits:

Alabama

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Alaska

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $20,748 |

| 2 | $28,103 |

| 3 | $35,458 |

| 4 | $42,813 |

| 5 | $50,168 |

| 6 | $57,523 |

| 7 | $64,878 |

| 8 | $72,233 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Arkansas

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Colorado

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Connecticut

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Delaware

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Florida

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

For Georgia Medicaid Eligibility and How to Apply, see our GA Medicaid Eligibility Guide.

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $30,851 |

| 2 | $41,768 |

| 3 | $52,686 |

| 4 | $63,603 |

| 5 | $74,520 |

| 6 | $85,438 |

| 7 | $96,355 |

| 8 | $107,273 |

Hawaii Medicaid Fee-For-Service Program

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $19,126 |

| 2 | $25,882 |

| 3 | $32,639 |

| 4 | $39,395 |

| 5 | $46,151 |

| 6 | $52,908 |

| 7 | $59,664 |

| 8 | $66,421 |

Hawaii Quest

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $14,380 |

| 2 | $19,460 |

| 3 | $24,540 |

| 4 | $29,620 |

| 5 | $34,700 |

| 6 | $39,780 |

| 7 | $44,860 |

| 8 | $49,940 |

Asset limits do not apply to individuals under age 19, or to pregnant women for the duration of the pregnancy plus 60 days.

Idaho

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Illinois

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $17,237 |

| 2 | $23,336 |

| 3 | $29,436 |

| 4 | $35,535 |

| 5 | $41,635 |

| 6 | $47,735 |

| 7 | $53,834 |

| 8 | $59,934 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Kansas

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Kentucky

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Louisiana

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Maine

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Maryland

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Massachusetts

Certain other noncitizens may also be eligible for MassHealth including certain children, pregnant women, disabled and seniors.

There is no income limit for individuals with disabilities who may have to pay a premium and a one-time deductible to qualify.

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Michigan

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Mississippi

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Missouri

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Montana

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $12,490 |

| 2 | $16,910 |

| 3 | $21,330 |

| 4 | $25,750 |

| 5 | $30,170 |

| 6 | $34,590 |

| 7 | $39,010 |

| 8 | $43,430 |

Nebraska

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Nevada

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

New Hampshire

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

New Jersey

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

New Mexico

In order to qualify, you must have an annual household income (before taxes) that is below the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $15,801 |

| 2 | $21,307 |

| 3 | $26,813 |

| 4 | $32,319 |

| 5 | $37,826 |

| 6 | $43,332 |

| 7 | $48,851 |

| 8 | $54,384 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

North Carolina

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

North Dakota

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Ohio

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Oklahoma

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Oregon

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Pennsylvania

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Rhode Island

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Texas

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $24,731 |

| 2 | $33,482 |

| 3 | $42,234 |

| 4 | $50,985 |

| 5 | $59,737 |

| 6 | $68,489 |

| 7 | $77,240 |

| 8 | $85,992 |

Utah

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Vermont

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

West Virginia

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

Wyoming

In order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

n order to qualify, you must have an annual household income (before taxes) that is less than or equal to the following amounts:

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $16,612 |

| 2 | $22,491 |

| 3 | $28,369 |

| 4 | $34,248 |

| 5 | $40,127 |

| 6 | $46,005 |

| 7 | $51,884 |

| 8 | $57,762 |

I have a question about income …. Me and fiancé are thinking about getting married but I can’t lose Medicaid on my daughters especially due to my oldest having to take 2 different seizure medicines. Let alone her one seizure medicine is like over $2,000 a month !!! She is also on SSI for her disability! There is no way I could afford that. I want to get married but I’m so scared of losing that for my girls. Didn’t know if there was a Medicaid we could get on and if I had to I could pay a premium monthly?

My fiancé is the only person that works and his yearly income is around 52,000 ! I just don’t want to lose Medicaid for my daughters and didn’t know if there was a way to make sure I don’t lose it. It would be for a family of 6 (my 2 daughters and I & my fiancé and his 2 kids). Didn’t know how the Medicaid for family’s worked ! Thanks and please let me know

My mom is in rehabilitation for a stroke, she is at the point of using up her Medicare . Her income is below Poverty level will they take what little money she gets

my mom has just moved from Washington state to Virginia she will be living with myself my husband and daughter because she has suffered a stroke her income by her self is 48,000 will she be eligible for medicad she doesn’t have any other insurance.